DNP and MUFG Aiming to Commercialize Digital IDs

Successfully conducted connection tests with Australian firms

Jun 3, 2024

Dai Nippon Printing Co., Ltd.

MUFG Bank, Ltd.

Tokyo, June 3, 2024, Dai Nippon Printing Co., Ltd. (DNP) and MUFG Bank, Ltd. (MUFG Bank) are partnering to develop systems to enable the use of Verifiable Credentials (VCs)1 , and digital certificates. The partners conducted a connection verification test with an Australian financial institution and a systems development company in May 2024 that utilized Digital ID managed information related to individual identities.

The verification test took into account the technical specifications under consideration by the European Commission (EC) for the European Digital Identity Wallet (EUDIW), an area where the EC is taking the lead in formulating technical specifications to realize highly reliable data distribution globally. And by leveraging the data formats and communication protocol established by the OpenID Foundation2 the partners were able to confirm that it is possible to interconnect Japan and Australia, which maintain data in different formats.

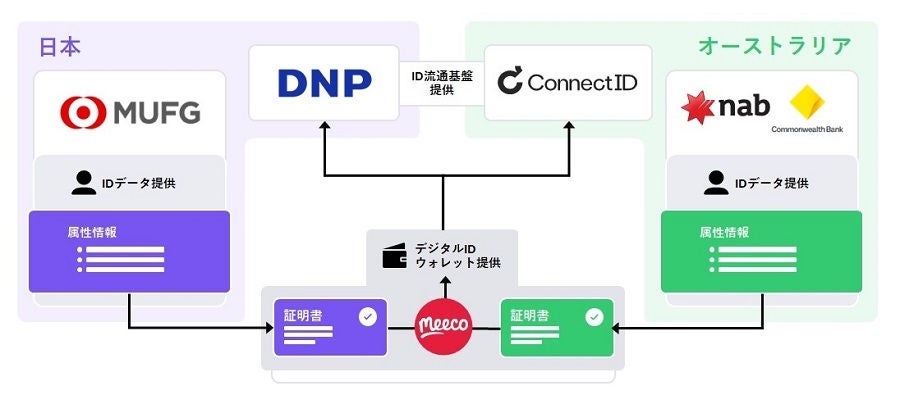

The partners have recently launched the Japan-Australia Cross-Border Interoperability Working Group. Other participating companies and organizations include, Australian Payments Plus, which provide the ID platform ConnectID3 that realizes secure and easy data distribution, National Australia Bank (NAB) and Commonwealth Bank of Australia (CBA), which provide ID data for ConnectID, along with Meeco,4 Australia’s leading provider of decentralized identity technology.

Participant roles and flow of data collaboration between Japan-Australia

Participant roles and flow of data collaboration between Japan-Australia

[Verification Tests, Other Initiatives]

In recent years, there has been an increase in travel and movement of people between Japan and Australia for reasons such as tourism and overseas study. At the same time, digitalization is accelerating in Australia, and damage such as unauthorized use of personal information, identity theft, and information leakage is on the rise. Consequently, there is a growing need to establish a highly secure and reliable distribution infrastructure for personal information.

The partners are looking to verify commercialization of Digital ID, in which consumers themselves manage their own identity-related information and conducted a verification test aimed at developing digital certificates. The verification test was the first involving Japanese and Australian private sector companies and was designed to verify interoperability of data linkage across national borders. Going forward, based on the results of the technical verification tests, the partners will conduct demonstration tests targeting a variety of use cases looking to improve consumer convenience in Japan and Australia. Such improvements may include the streamlining of bank account opening procedures for migrants and tourist ticket purchases.

[Working Group Company Roles in Verification Tests]

| DNP | ・Provision of digital ID wallet technology in Japan ・Providing digital ID wallet technology from the Japanese side |

| MUFG Bank | ・Inspection of governance rules to enable Japan-Australian cooperation ・Provision of ID data in Japan |

| Australian Payments Plus | ・Provision of ConnectID in Australia |

| NAB | ・Provision of ID data for ConnectID |

| NAB | ・Provision of ID data for ConnectID |

| Meeco | ・Provision of Digital ID technology |

Going Forward

Based on the verification test results, the partners will work together to commercialize Digital ID. While referencing EU regulations on electronic identification and trust services, or eIDAS5, we aim to develop services and products that prevent identity theft and data tampering in electronic transactions by individuals and companies, the social implementation of a secure and reliable data distribution platform, and the development of services and products.

Results of the verification tests will be made public at the European Identity and Cloud Conference (EIC) 2024, the EU's largest identity-related event, which will be held in Berlin, Germany from June 4th to June 7th, 2024.

- VCs are verifiable digital certificates and data models.

- OpenID Foundation: A non-profit international standards organization established in the United States in 2007. The foundation is engaged in technology standardization related to the Internet identity layer and API access management.

- ConnectID® is an Australian-owned digital identity solution which makes it easier for customers to verify who they are, using organisations they already trust. ConnectID was the first non-government digital identity exchange accredited under the Australian Government’s Trusted Digital Identity Framework (TDIF) and is supported by major Australian banks. ConnectID is an initiative of Australian Payments Plus (AP+) which brings together eftpos, BPAY and NPP Australia as one organisation. To find out more, visit connectid.com.au.

- Meeco was established in Australia in 2012 and is now a global provider of decentralized and cloud identity management and authentication services. With operations in Australia, Europe, and the United Kingdom, Meeco’s focus is on enabling their enterprise partners to develop and deploy trusted identity networks, including the realization of interoperability for identity and personal data.

- eIDAS regulations: Regulations regarding sound electronic transactions in the EU, which aim to promote interoperability within the EU of services related to electronic signatures and data distribution.

- Product prices, specification and service contents mentioned in this news release are current as of the date of publication. They may be changed at any time without notice.

- Product specifications and service content listed in this news release are current as of the date of publication. They may be changed at any time without notice.