[Executive Interview] DNP Aims to Establish an “Intellectual Capital Supply Chain”: A New Model of Manufacturing that Builds Trust and Value

Due to existential geopolitical risks and lessons learned from the COVID-19 pandemic, supply chains are no longer viewed merely as means of procurement and logistics; they have become strategic assets capable of significantly influencing corporate competitiveness. In this context, DNP is promoting the innovative concept of an Intellectual Capital Supply Chain, which is aimed at creating previously unattainable value by incorporating knowledge and experience into the realm of goods distribution. Beyond this, DNP aims to develop a new manufacturing model for Japan that leverages the nation’s strengths. We spoke with Senior Managing Director Toru Miyake about how integrating goods with experience will create new values that provide peace of mind and emotional satisfaction to consumers.

- Procurement power translates into competitive advantages: A new perspective on supply chains

- From value chain to Intellectual Capital Supply Chain

- Intellectual Capital Supply Chain opens a new horizon for Japan’s manufacturing sector

|

|---|

Toru Miyake

Senior Managing Director, Dai Nippon Printing Co., Ltd. In charge of Strategic Business Planning & Development Division, Purchasing Division, and Intellectual Property Division.

After joining the company in 1982, Miyake was assigned to departments dealing with research and development as well as display business before being appointed as General Manager of the R&D Division and the General Manager of the Purchasing Division.

At the Purchasing Division, he spearheaded efforts to promote sustainability management and strengthen the supply chain. Miyake assumed the post of Managing Director in 2023, and his current post in 2025. He also serves as a guest professor at Yamagata University and as a member of the Management Committee of the Japan Science and Technology Agency’s JST-Mirai Program, proactively pursuing value creation through industry-academia-government collaboration.

Procurement power translates into competitive advantages: A new perspective on supply chains

Q: Could you explain the contexts in which supply chains are considered "corporate strategic assets"?

During the COVID-19 pandemic, many companies confronted a harsh reality: the assumption that necessary goods can always be obtained on demand is no longer valid. For instance, a company was unable to deliver a newly built home to its owner because the necessary toiletry and water heating equipment were not received on time. Similarly, production lines in the automotive industry remained idle due to a lack of semiconductor deliveries. Such occurrences happened simultaneously around the globe. As for consumers, the sight of empty store shelves lingering for extended periods must still be fresh in their minds.

When a single supply point was disrupted, other points became inoperable in a chain reaction. Confronted with such fragility, the supply chain was redefined as an asset that can significantly impact corporate trust and competitive advantage. DNP faced similar challenges, particularly in the procurement of semiconductors for smart cards. However, we were able to identify risks early and implement adequate measures to ensure a stable supply. This success can be attributed to the fact that we had a comprehensive understanding of the entire supply chain, from “downstream” logistics routes and processing phases to “upstream” raw material production sites in the semiconductor supply chain.

|

|---|

Our ability to fulfill commitments to clients, therefore, hinges on knowing where relevant products are manufactured, the delivery routes used, and any vulnerabilities that may arise in the supply chain. In other words, the idea that procurement power equates to business competitiveness became clear as we navigated the crisis. Additionally, uncertainty in supply chains has become the norm in recent years due to geopolitical risks, natural disasters, and strengthened regulations. While excessive dependence on certain countries, regions, or companies may seem cost-effective, it does not represent overall optimization. We have entered an era where designing a comprehensive supply chain by incorporating supply flexibility and resilience directly influences the foundation of corporate value.

Q: Do you think the requirements for supply chains themselves have transformed?

I believe that the era of merely preparing and delivering materials by a set deadline has clearly ended. We have already entered a new phase where every choice we make in each process — procurement, manufacturing, and logistics — directly affects how consumers select products. In this context, leading companies are evolving the supply chain from a mechanism designed to prevent disruptions in the flow of goods to one that generates value — a true “value chain.”

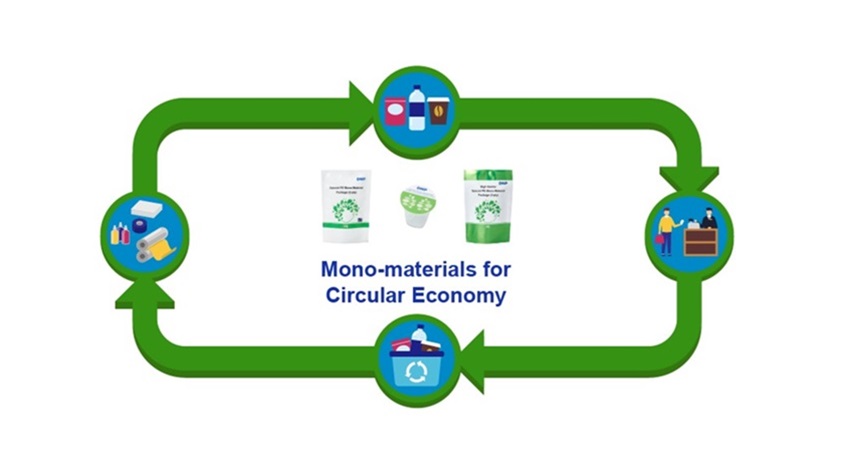

For example, overseas companies, primarily in the United States and Europe, are rapidly shifting to materials that do not contain organic fluorine compounds (PFAS: per- and poly-fluoroalkyl substances). In Japan, discussions about PFAS have not yet matured; however, PFAS is reportedly associated with health risks, prompting overseas markets to increasingly demand PFAS-free materials and products in procurement and sales. This reflects the idea that the selection of materials in procurement itself serves as a proposal for companies to deliver value and differentiate themselves in the value chain.

Instead of adjusting procurement only immediately before a final product is made, companies must consider associated risks and sustainability during the planning and design phases. They should also incorporate societal requirements such as environmental protection, safety, and human rights — in addition to materials selection, manufacturing processes, and logistical conditions — when making decisions regarding the supply chain. The more companies engage in this practice, the more compelling consumers’ reasons to choose them become. From this perspective, DNP designs “value chain reactions” that will ultimately be delivered to consumers.

From value chain to Intellectual Capital Supply Chain

Q: I hear you are thinking beyond the value chain. Could you expand on this idea?

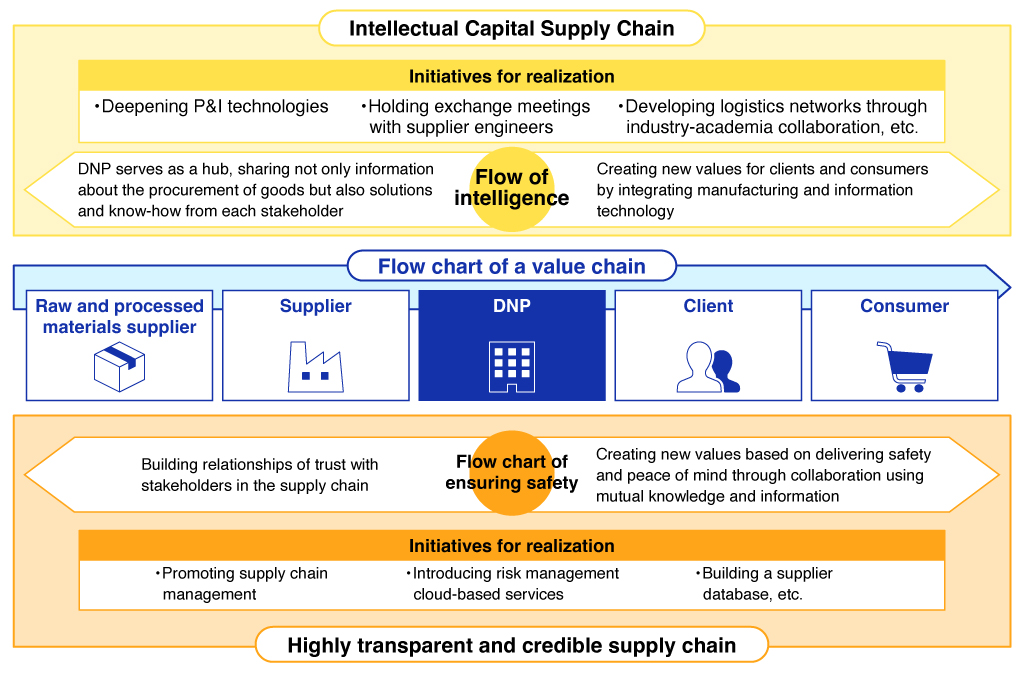

If the value chain is a mechanism for generating value in the flow of goods, we should elevate it to a higher level, focusing on the flow of intelligence. I call this an Intellectual Capital Supply Chain. There are limits to the value we can add if we only engage in connecting goods. However, by integrating intelligence such as suppliers’ technologies, on-site know-how, knowledge from universities and research institutes, and ideas from clients to address problems, we can develop new solutions and create value that conventional approaches cannot achieve. In other words, the Intellectual Capital Supply Chain represents a framework for delivering greater value to society by circulating knowledge and expertise gleaned from experience, in addition to the procurement and supply mechanisms of goods. DNP’s “P&I (Printing & Information)” approach, which has led to the development of original technologies, know-how, and skills, will support the realization of this supply chain, serving as a foundation for generating new value by connecting various areas of intelligence.

Q: What initiatives is DNP taking to realize the Intellectual Capital Supply Chain?

I believe that transparency and credibility should be the foundation of a supply chain. It is important to investigate the origin of raw materials, consider human rights and environmental impacts, and identify the risks involved at each stage of the product life cycle by covering not only primary suppliers but also secondary and tertiary suppliers that provide materials. We then share this information both internally and externally.

To achieve this, DNP has introduced a risk management cloud-based service that visualizes which countries or regions are supplying raw materials and identifies areas in the supply chain that are impacted in real time during incidents such as earthquakes, disasters, and labor strikes. We are currently gathering information on the supply chains of materials by product to accumulate the necessary data. By doing so, we will be able to swiftly navigate around affected areas and find alternative sources, thereby enhancing supply stability.

|

The Intellectual Capital Supply Chain will be built based on the highly transparent, credible supply chain with DNP serving as a hub. |

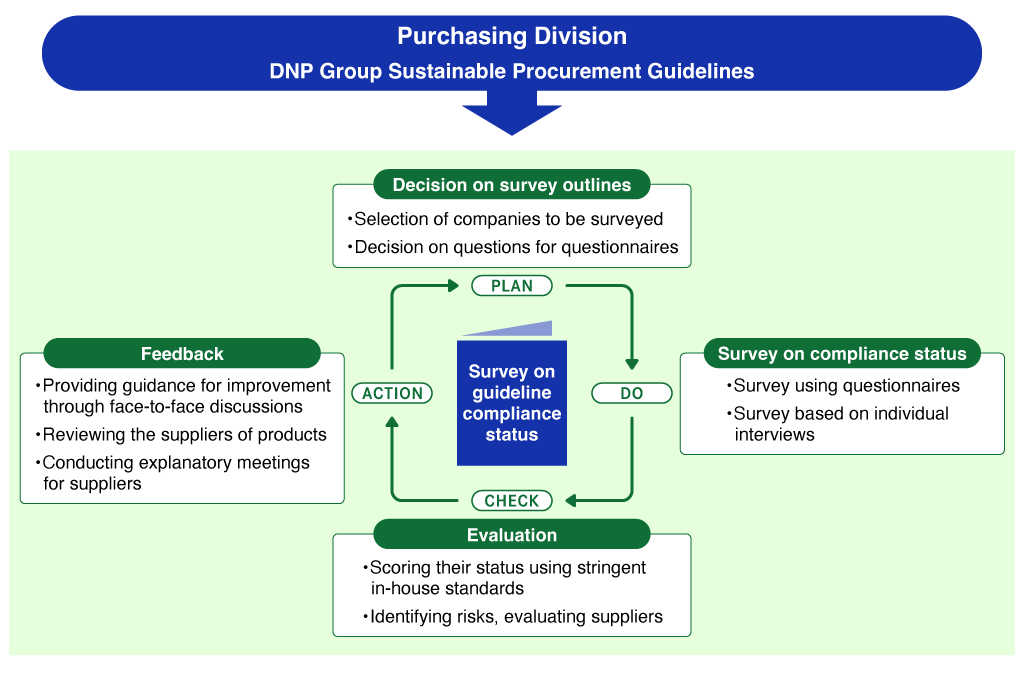

Furthermore, we will promote supply chain management based on established guidelines. Our Purchasing Division plays a central role in identifying individual risks and challenges through questionnaires and interviews conducted with suppliers, in accordance with the items outlined in the DNP Group Sustainable Procurement Guidelines. When necessary, we dispatch specialized teams to provide on-site support for problem-solving. The mutual commitment to improvement and growth between DNP and its suppliers is the foundation of trust in the Intellectual Capital Supply Chain.

|

Survey on guideline compliance status |

We hold meetings with suppliers to exchange information, including knowledge and expertise on new technologies and materials. During these meetings, young engineers engage in active discussions, often paving the way for a new approach to purchasing activities. Also, in a joint research project with a university, we are conducting simulations on optimal transportation routes by mapping domestic logistics networks while factoring in the “2024 problem in logistics*.”

- *The 2024 problem in logistics refers to the increased likelihood of shortfalls in the capacity to transport goods following the imposition of a cap on truck drivers' working hours (960 hours per year) in April 2024, as part of the government’s workstyle reform. It is feared that transportation costs will rise, delivery fees will increase, driver incomes will decrease, and labor shortages will worsen, affecting all stakeholders, including shippers, freight forwarders, and consumers.

Intellectual Capital Supply Chain opens a new horizon for Japan’s manufacturing sector

Q: Why does Japan need to shift to an Intellectual Capital Supply Chain?

The need for this shift becomes clear when examining the “competitive axes,” or essential factors for company growth. China is constructing an “industry chain” involving neighboring countries and regions as part of its national strategy through the Belt and Road Initiative and other policies. This model is designed to drive the overall economy, characterized by production concentration, export-driven scaling, and significant advantages in terms of scale and speed. Competing with China over quantity and price on an equal footing places Japan at a disadvantage.

Meanwhile, Japan’s strengths lie in its ability to customize products precisely according to each client’s requirements and to flexibly accommodate customers’ requests for a wide variety of products, including small production lots. What is demanded of us as Japanese companies is not to produce products that fit the greatest common denominator of clients, but to provide solutions that address immediate problems by redeploying technology, experience, and sensitivity according to specific purposes.

For example, one company may excel in producing materials, another may specialize in processing, and yet another may have expertise in logistics. Rather than relying on a single company to possess all these capabilities, it is essential to realign companies optimally based on the requirements of each challenge. Japan as a whole can demonstrate considerable strength only if the capabilities of each company are connected through Intellectual Capital Supply Chains, rather than through companies operating in isolation.

|

|---|

We can also learn a great deal from the realities of the industry. The number of Chinese factories recognized by the World Economic Forum as “lighthouses” (industry leaders achieving exceptional results in productivity, supply chain resilience, customer centricity, sustainability, and talent) is more than 60, an overwhelming number compared with just a few in Japan. This indicates that, despite having world-renowned technologies and manufacturing skills, Japan has not yet established a comprehensive mechanism for disseminating and expanding these capabilities. It is therefore important to share intelligence, knowledge and expertise to swiftly leverage them at other manufacturing sites. The key to this is the Intellectual Capital Supply Chain.

Q: Could you describe a new mode of manufacturing enabled by this supply chain?

Conventional manufacturing typically concludes its role with the production and delivery of products. However, moving forward, the focus will shift to the question of what kinds of experiences and values we can convey to consumers through our products. The new manufacturing I am referring to is one that provides robust solutions through both goods and services, ultimately resulting in peace of mind and emotional satisfaction for the public.

We have the culture of omotenashi, a form of Japanese hospitality characterized by a genuine desire to meet people’s needs. It focuses on delivering experiences that go beyond expectations and touch people’s hearts, instead of simply providing convenient goods. Incorporating this spirit into products and services will result in competitive advantages not seen elsewhere in the world. To achieve this, the Intellectual Capital Supply Chain, which connects a diverse range of expertise in materials, processing, information technology, and logistics, is essential. This cannot be accomplished by a single company alone. Expanding the network through Intellectual Capital Supply Chains is a must for the new manufacturing model to take root in society.

Q: So, not only DNP but also many other companies must participate for Japan to sharpen its competitive edge in the world. Finally, could you give us some ideas about how to realize this?

The Intellectual Capital Supply Chain involves a diverse range of like-minded parties, including suppliers, client companies of various sizes, partners, universities, and research institutes — each bringing their expertise to share and collectively amassing significant power. DNP, for its part, is committed to leading value co-creation as a hub that connects these like-minded parties by leveraging its unique strengths in “P&I,” the sophisticated technology developed from printing processes. We aim to expand the framework of co-creation with multiple partners, elevating relationships beyond those between buyers and sellers. Together, it is essential to foster a virtuous cycle in which participation in this framework enables suppliers to discover new business opportunities, client companies to secure sustainable supplies, and consumers to gain peace of mind and trust.

We hope to establish Japan as a new manufacturing superpower by harnessing DNP’s expertise in manufacturing and delivering experiences, along with its extensive network of companies and partners across the nation.

- *The information in this article was accurate as of the publication date.

December 22, 2025 by DNP Features Editorial Department