Dai Nippon Printing Co. moved with lightning speed to announce September 21 that it would start providing cloud services to allow credit card companies to deal with Apple Pay—only two weeks after Apple announced the October introduction of its smartphone-based payment service to Japan.

The mobile payment solutions will be provided in conjunction with Gemalto N.V., an Amsterdam-based global leader in digital security. Some might wonder, however, how DNP was able to so readily offer a state-of-the-art, end-to-end service associated with Apple’s smartphone-based payment service, which is designed to provide a fast, easy and secure method of paying commuting fares and purchasing daily-use items with a single touch.

In fact, DNP is one of Japan’s leading providers of cloud services for managing credit card numbers and other sensitive data to ensure secure mobile phone-based payment transactions. The company is also a major supplier of technology involving near-field communication (NFC)—a form of contactless communication between electronic devices.

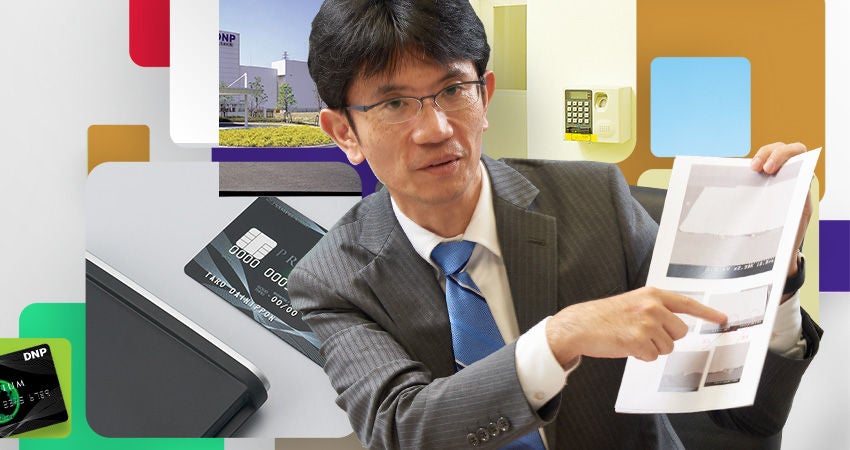

Tsuchiya: The man behind DNP’s mobile business success

DNPでモバイルサービスを成長させた立役者は、土屋輝直だ。10年ほど前、当時日本市場に出回り始めた非接触ICカードの通信性能の向上に取り組み、課題を特定し、解決した人物である。土屋は、牛久工場(茨城県)に6年間勤務した後、2012年にモバイルサービス部の部長に就任した。与えられた課題は、エンジニアの土屋が今までやったことがないビジネス開発だった。しかも、数年後に数十億円規模の事業を創り出すというミッションが託されていた。

“It was a bolt from the blue,” Tsuchiya said of his transfer. “Smart cards and smartphones both use the same technology: contactless IC communication. But my task is completely different in that I have to explore business potentials to identify what customers will likely want, rather than thinking about what intrigues me as an engineer. It required a drastic change in mind-set.”

Indeed, Tsuchiya’s initial years in the position were far from easy. “I tried to imagine a novel lifestyle in which people depend on smartphones for everything they do; but in reality people don’t behave like that,” he said. “Users’ responses to our undertakings were lackluster at best.”

The wheel of fortune has turned in Tsuchiya’s favor in the past year or so, however, with IT giants such as Apple, Samsung and Google successively announcing the launch of mobile wallet services, while financial institutions, including J.P. Morgan Chase, started offering digital wallets.

“The market for mobile wallets finally took off this year, and our preparations are beginning to pay off,” Tsuchiya said.

Playing an important role in realizing a cashless society

DNP, which since 2005 has supplied NFC services and solutions for mobile phone payments—including the DNP Mobile Wallet Service that was launched in 2012—has four computer platforms for payment processing, cloud payments, authentication and the Internet of Things in digital security areas. Cloud payment and authentication payment platforms, in particular, play a vital role in DNP’s endeavors to develop end-to-end solutions for smartphone-based credit and e-money payments.

DNP’s undertakings coincide with the Japanese government’s promotion of cashless transactions in the run-up to the year 2020 to raise Japan’s electronic payments rate from the 18.5 percent (¥56.4 trillion) of consumer spending registered in 2014. According to the New Payments Report 2015, the rate is projected to rise to 28.5 percent of consumer spending in 2020, but this is still much lower than the 2012 figures for South Korea (83 percent), China (72 percent) and Norway (60 percent).

The cloud platform, which allows the provision of solutions launched this year through a Gemalto tie-up, is designed to protect sensitive credit credentials on smartphones. “In our service, the system issues a token to the smartphone that a user uses for purchases, and the token is then de-tokenized to the real credit card number in the final phase of payment transactions, in processes called tokenization and de-tokenization, respectively,” Tsuchiya explained. DNP hopes to rake in about ¥5 billion in sales from the new cloud service and its DNP Mobile Wallet Service over five years through the end of fiscal 2020. Its main clients are banks, credit card companies, large-scale retailers and mail-order companies, among others.

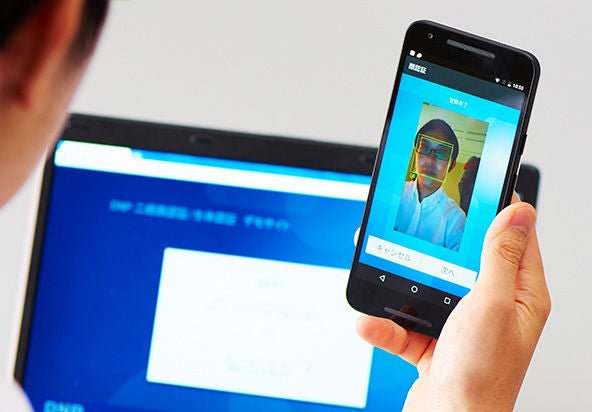

Heralding smartphone-based biometrics authentication

Authentication is another pivotal factor in financial technology. DNP has built an authentication platform that allows business operators to freely choose to use such biometric information as fingerprints, irises, facial features, voice prints and palm veins (though the latter is not used for smartphones), in addition to conventional methods such as a one-time password. “Major financial institutions are trying to incorporate biometric authentication into their services based on standards set by FIDO (Fast IDentity Online) Alliance,” Tsuchiya said, adding that DNP joined the alliance last year. “Biometric authentication is very handy for users, considering the fact they often have trouble remembering different PINs for several different financial institutions,” Tsuchiya said. “In a year or so, I think we might see people using biometric data stored in mobile wallets for authentication when withdrawing cash at ATMs and on other occasions.”

DNP is also exploring new horizons in sales promotion—one of its longtime business strengths. The company is developing a wide variety of smartphone-based services, which take advantage of the sensors built into smartphones, including GPS. One notable example is the use of push-notification, in which messages pop up on a mobile device. “For example, mobile wallet users can receive a discount coupon when they are near a certain shop or restaurant,” Tsuchiya said. “When users learn they can get, say, a 10 percent discount on purchases using the coupon, they might decide to buy merchandise there. The timing and content of the offer thus become important.”

Dynamic cards: Potential next-generation technology

DNP is also keeping an eye on dynamic cards, the technologies of which have the potential to give rise to innovations, just as smartphones are doing at present.

Dynamic cards—also known as smart credit cards—can embrace multiple plastic credit cards and turn them into an all-in-one payment solution. “You can input the data of as many as 20 plastic cards into a dynamic card by using a smartphone,” Tsuchiya explained. “We lodged relevant patent applications in anticipation of the arrival of such a next-generation card several years ago. Fortunately, business opportunities for such gadgets are expected to bloom in the near future.” DNP is currently proposing dynamic cards for banks and credit card companies.

Tapping into new business streams almost always involves ups and downs. Tsuchiya is no exception:

“I’ve experienced several failures, but thanks to DNP’s corporate culture I was allowed to carry on, provided that I double my efforts to make tangible achievements,” he said. “Provided, of course, that the failure is not fatal, but rather, one that can lead to new opportunities.”

- Published: October 21, 2016

- DNP department names, product specifications and other details are correct only at the time of writing. They are subject to change without prior notice.

October 21,2016 by DNP Features Editorial Department